Precision Driven Health partners with MoleMap in AI project to improve skin cancer detection

Precision Driven Health (PDH), New Zealand’s leading health data research initiative, has today announced it is working with MoleMap on its use of Artificial Intelligence (AI) to improve the early detection of skin cancer.

PDH Chief Executive Dr Kevin Ross says the $2 million research project will enhance the AI algorithm that MoleMap has developed to differentiate cancerous skin lesions from benign lesions.

“Every year nearly 400 New Zealanders die from skin cancer and studies indicate that early detection could have greatly improved the chance of survival in the majority of cases,” Dr Ross says.

“This project has the potential to increase access to skin checks by extending the technology for use at the primary care and general practitioner level, and thereby enabling more New Zealanders access to early detection for skin cancer.”

MoleMap Chief Technology Officer Adrian Bowling says the PDH partnership builds on initial research developed with IBM Research in Melbourne on a small subset of data.

“The partnership with PDH will provide us with access to a larger, wider set of data as we continue to work with experts at the University of Otago in Dunedin, and Monash University in Melbourne, to enhance this ground-breaking technology,” Mr Bowling says.

Computer-based systems for recognising malignant moles have been developed over the past 20 years but have had limited uptake. With the advent of AI, combined with large databases and “deep learning” algorithms, new opportunities for the use of these technologies can be explored.

“Published studies and our own research suggest that it is possible for a system-based AI to be at least as good as dermatologists in differentiating cancerous lesions from benign lesions,” Mr Bowling says.

The research project will include clinical trials in New Zealand and Australia once the algorithm has been enhanced. As essential part of the research is to ensure that the unique population of Aotearoa is taken into account and all skin types will be tested.

Dr Ross says that, as with all PDH projects, a key focus is applying new techniques in data science to advance Māori health outcomes.

“Māori do not have a high incidence of melanoma; however, there is a high mortality rate for those who have melanoma. This has generally been seen as a result of Māori, like many other New Zealanders, presenting with later stage melanoma when it is difficult to cure. Being able to better detect melanoma in Māori could help decrease this mortality risk and save lives.”

For more information and/or an interview with Dr Kevin Ross, contact:

Nicole Gray

Communications Specialist

nicole@precisiondrivenhealth.com

About Precision Driven Health

The Precision Driven Health partnership (PDH), established in March 2016, is one of the most ambitious data science research initiatives to be undertaken in New Zealand. The partnership unites the health IT sector with health providers and universities to create health and commercial opportunities for New Zealanders. Research is focused on applying new data science techniques to understand the massive volume of data about an individual captured by health information systems, consumer devices, social networks, genetic testing, and other sources. Visit our website precisiondrivenhealth.com.

About MoleMap

MoleMap’s team of leading dermatologists and melanographers have been detecting and diagnosing melanoma for over two decades, using a unique skin mapping system that’s designed to track changes in the skin over time. MoleMap has over 40 clinics around New Zealand serving over 250,000 patients nationwide. Visit our website www.molemap.co.nz.

More than 500 Plastic-filled parcels mailed to MPs

More than 500 letters and parcels filled with nonrecyclable single-use plastics have now been mailed to MPs in Parliament via freepost.

This week alone, the plastic2parliament initiative mailed over 130 plastic-stuffed letters to NZ First MP Jenny Marcroft to ask if her Party has a single-use plastic reduction policy.

“Plastic waste is essentially environmental change in solid form,” said Wade Bishop, initiator of plastic2parliament.

The plastic2parliament initiative encourages the public to include non-recyclable plastics in their mail to MPs to illustrate the problem.

“The problem with these plastics is that once they’re in the environment they don’t go away but continue to break down into smaller and smaller particles.” Wade Bishop said.

The letters ask MPs to support the Product Stewardship changes to the Waste Minimisation Act 2008 (WMA) proposed by the Government which includes many categories of plastic packaging but also ask for bans of avoidable plastics and for all political Parties to have a plastic-waste reduction policy.

“Plastics are now in our water, our air, our food and we now eat about a credit cards worth or more every year. There’s plenty of research making its way into media about endocrine disrupting chemicals in plastic packaging and most recently to type 2 diabetes in research out of Australia.” Mr. Bishop said. “One could say that the cost of over-production of plastics is more than just the economics of dealing with the waste alone.” (Ref. sciencedirect.com; and baker.edu.au)

Plastic2parliament is encouraging citizens concerned about the growing epidemic of avoidable and single-use packaging plastics to engage in penning letters to MPs in Parliament via the Parliamentary Freepost address. The initiative asks politicians to focus regulation on the producers of plastic packaging, while urging the public to stuff their large envelopes full of nonrecyclable plastics to make the point.

The plastic2parliament initiative continues to grow quickly with membership numbers of the Facebook Group now more than 900 people since the initiative began in early October.

“People are tired of plastic pollution being framed as a consumer issue, or one that is simply a matter of better collection and recycling.” Wade Bishop said.

“The fact is, it’s more about unfettered production of higher and higher volumes of single-use plastics. It’s a production issue driven by the economic benefits of cheap plastics, which are cheap only because the true lifetime cost of those plastics is not currently carried by those producers.”

The global oil industry is investing US$180 billion in new plastic production plants, over this coming 10 years, with the aim to increase production by 40% from the 348 million tonnes per year presently. Some estimates suggest that plastic waste volumes will quadruple by 2050. (Ref. theguardian.com; and sciencemag.org)

“We already know that plastic waste and pollution is an enormous problem here in New Zealand, and globally. The current investments to increase plastic production exponentially in the face of the problems we already see is criminal. It’s foolish to think that New Zealand will not experience a massive increase in plastics given this mounting global supply pressure.” Mr Bishop said.

Media Contact: Wade Bishop

https://www.facebook.com/groups/plastic2parliament/

M: 021 432045

E: plastic2parliament@gmail.com

ABOUT PLASTIC2PARLIAMENT

Plastic2parliament is a letter-writing initiative started by Wade Bishop of Christchurch which encourages citizens concerned about the explosion of single-use plastics to include these products with their letters to MPs using the Parliamentary Freepost address. The purpose of the initiative is to creatively emphasise how these nonrecyclable products cannot be avoided by consumers and that the actual cause of plastic waste is over-production and use by manufacturers.

Simon Bridges asked to put aside politics on plastic waste

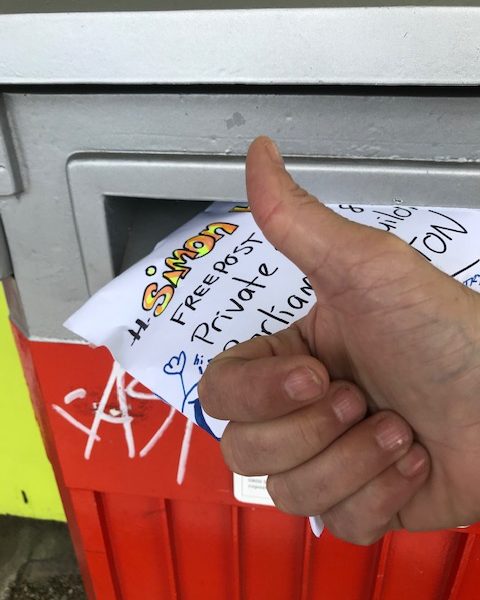

This week the plastic2parliament initiative mailed well over 130 plastic-stuffed letters to National Party leader Simon Bridges asking him to “do something crazy” and put aside party politics on plastic waste.

The letters asked him to support the Product Stewardship changes to the Waste Minimisation Act 2008 (WMA) proposed by the Government including plastic packaging.

“A massive opportunity to get on top of New Zealand’s plastic waste problem was lost during the 9 years of a National Government where they essentially sat on the powers contained in the WMA and did absolutely nothing to deploy them. Now Simon Bridges can act constructively to support the Government’s proposed changes and announce a meaningful plastic reduction policy of his own as well.” said Wade Bishop, the initiator of the letter writing to MPs.

Plastic2parliament is encouraging citizens concerned about the growing epidemic of avoidable and single-use packaging plastics to engage in penning letters to MPs in Parliament via the Parliamentary Freepost address. Citizens are also being asked to stuff their large envelopes full of non-recyclable plastics.

“I see this as a creative way to physically take this unfettered, over-production of single-use plastics directly to the desks of MPs where they can’t ignore it.” said Mr. Bishop.

“MPs need to acknowledge that plastic waste is a production problem, not a consumer issue, and advocate for meaningful plastic reduction policies (within their respective political Party) and to regulate the producers of these plastic products,” he said.

The plastic2parliament initiative shows no sign of slowing down. Membership to the Facebook Group now growing beyond 800 people. In turn, its members have delivered more than 350 letters and parcels of non-recyclable plastics to MPs since the middle of October.

“This might seem like a frivolous thing to be doing, but we are drawing attention to very serious issues that the public and MPs need to be fully aware of,” Wade Bishop said.

“The fact is, while we already now know that plastic pollution is an astonishingly big problem, global oil companies are investing US$180 billion in new plastic manufacturing plants aiming to increase virgin plastic production by 40% before 2030.

“This is the true cause of the explosion in single-use plastics around us here in New Zealand. This clearly illustrates that it is a production issue and not a matter of consumer choice as we always seem to hear.” he said.

Plastic2parliament is advocating that waste policy and legislation focus on the source of single-use plastics by regulating the producers of them to reduce volumes of plastic packaging entering the economy and then the environment.

“Setting measurable reduction targets on the import of virgin plastic resins, used for packaging, and, on import volumes of new plastic packaging, would be one clear way of measuring the success of any regulations that are put in place.” Mr. Bishop said.

“Only about 20% of plastics are recycled each year and many are not even recyclable for various reasons. With plastic production set to increase 40 percent in the coming 10 years, recycling is clearly not the solution to the plastic waste problem. The best solution is making less in the first place.” he said.

ENDS

Expat Brit Makes Extra $280,000 on Pension by Transferring to New Zealand

The on-going Brexit negotiations and subsequent demise of the UK exchange rate have left many British expatriots who have moved to New Zealand wondering what to do about their UK pensions.

Should they wait for a more favourable exchange rate, or bite the bullet and transfer their pensions now – knowing that it could get far worse before it improves?

Alison Renfrew, pension transfer specialist at Lyford Investment Management, has been advising British expatriots for 17 years on their options for transferring their pensions. She recommends that with some exceptions, transferring now is probably the better option.

Why?

“Firstly, if you’re worried about the exchange rate, you can keep your funds invested in GBP and convert them into NZD years in the future,” says Renfrew.

“More importantly though; pension transfer values seem to be really high at the moment.

“I advised a client earlier this month that her transfer value had increased by 25% in just six months. She now has another £145,168 ($281,776NZD) to transfer. This is phenomenal”.

Renfrew has not seen such a dramatic positive change in transfer values before.

On the very same day, Renfrew had a conversation with another client about her pension transfer value. She was offered a Cash Equivalent Transfer Value (CETV) of £59,731, or a pension of £900 p.a.

You would have to receive £900 p.a. for 66 years before you broke even – before you saw any investment returns from your retirement savings.

“It is 100% illogical to accept such a lousy deal,” Renfrew says.

When Renfrew compared current CETVs with promised pensions, she found little incentive to choose to have a taxable pension paid from the UK compared to receiving a far higher non-taxable income in New Zealand based on realistic investment projections.

“What Brits really don’t like is knowing that if they die prematurely their spouse will only get half of the income. In some cases, the spouse gets nothing”.

A major benefit of taking control and investing your transfer value to provide you with a retirement income is that you can access your money if you need to. Conversely, there’s no access to your retirement pot if you’ve elected to take a pension.

“Where is your financial security if you can’t access your money in an emergency?” Renfrew asks.

There are a couple of exceptions, of course.

Renfrew cautions Brits and returning Kiwis not to transfer their pension funds if they are uncertain where they’ll live for the five years after they have transferred their pension funds to NZ, due to tax obligations.

Renfrew further cautions that before deciding to transfer you need professional advice to ensure that all your options have been considered.

“Maybe you are one of the few who have a very attractive pension, and converting to cash would be madness.

“You really need to seek independent advice from a New Zealand investment adviser specialising in pension transfers before making the decision to transfer, because individuals simply don’t have access to the same resources advisers do. It’s important to make informed choices.”

Alison and Richard Renfrew of Lyfords have been specialising in UK to New Zealand pension transfers for over 17 years. Visit their website to find out more.

Varidesk Looks To Transform The Kiwi Office Working Environment

Varidesk, a popular international brand that has been making inroads into the New Zealand market, is looking to change the traditional Kiwi office working environment with its innovative standing desks.

These desks allow for an easy transition between sitting and standing when working and feature desk converters that can even transform a normal desk into a sit-stand desk.

Varidesk NZ Director Dave Roberts says having a working environment that involves intermittent periods of sitting and standing can dramatically improve employees’ productivity, happiness and overall well-being.

“We are delighted to bring to market an exciting desk alternative, which will improve the work life of employees and home workers alike,” says Roberts.

“Companies are finding it harder than ever to recruit and retain talented employees. Creating an active workspace that thrives off employee energy and happiness is now integral to attracting the talent you need to grow your business.”

Varidesk standing desks are being used by organisations such as Sanitarium, PowerCo, and Victoria University – and for good reason, says Roberts.

“Recent studies have shown using a height-adjustable desk improves mood and boosts energy levels along with health improvements such as reduced risk of type 2 diabetes, cancer and heart disease,” he says.

Roberts notes that when people first start using a Varidesk they usually notice within a few days that their back and neck pains are either significantly reduced or dissipate completely. Notable improvements also include energy and focus.

“Since using the VariDesk, I’ve had fewer issues with back pain and am finding my posture improving each day incrementally. I’ve also noticed my attention drifting far less and I’m managing to stay focused for longer stretches during the day,” says Dan Grayson, Editor in Chief of Gameplanet.

All Varidesk products are high quality and easy to set up – there’s no flat-pack assembly, and you can be ready to work within minutes.

“It’s now easier than ever to transform your office into a happy, healthy and productive workspace without compromising on quality,” says Roberts.

Cin7 Agrees to Strategic Investment from Rubicon Technology Partners to Accelerate Global Growth

AUCKLAND, NEW ZEALAND – September 26, 2019 – Cin7, a pioneer in cloud-based inventory management software (IMS) and point-of-sale (POS) solutions, has agreed to a majority investment from Rubicon Technology Partners (“Rubicon”), a US-based private equity firm that invests exclusively in enterprise software companies. The funding will be used to accelerate Cin7’s global growth strategy through product innovation, sales expansion and continued investment in customer success.

“This investment validates all of the hard work our team has put in to building a market-leading product and delivering best-in-class support to our growing, global customer base,” said Danny Ing, Founder and Chief Architect of Cin7. “We are now doubling-down to reach the global growth we know is possible with a great partner that has the resources, operational expertise and cultural fit to accelerate our growth.”

Cin7 helps growing businesses optimize inventory, lower costs and maximize cash flow by providing a single platform to automate the sale, purchase and delivery of products across multiple distribution channels. Cin7’s highly scalable, feature-rich, and cloud-based IMS platform provides powerful core functionality, including warehouse management and POS, along with the industry’s most extensive list of over 450 marketplace integrations. Thousands of end-users around the world use Cin7 to safely manage stock and streamline their order processes as they add sales channels and expand to new markets.

“With the most comprehensive, easy to use and swift-to-implement inventory management software product on the market, Cin7 is ready to become the clear leader in the global IMS market,” said Jason Winsten, Partner, Rubicon. “The company has built a highly differentiated IMS solution that solves a critical and complex problem for growing merchants selling their products through multiple online and offline channels. Cin7’s proven ability to capture global market share provides a strong foundation for continued growth, which we plan to aggressively accelerate with our investment in and partnership with the Cin7 team.”

The investment is subject to approval from New Zealand’s Overseas Investment Office.

Media Contact:

David Leach

p: +64 21 586 715

About Cin7

Cin7 inventory management software and POS system keep your stock in line with orders across every sales channel and stock location. With extensive integration and workflow automation, Cin7 helps contain costs, and maximize margins and cash flow for B2B, B2C, online and brick-and-mortar business. Cin7’s integrations include 3PL warehouses, retailers (with built-in EDI), online marketplaces, eCommerce platforms, accounting solutions and more. For more information, please visit www.cin7.com

About Rubicon Technology Partners

Rubicon Technology Partners invests in enterprise software companies with proven products and talented management teams to help grow and scale their businesses. Rubicon enables companies to adapt to the changing requirements of their businesses as they grow and scale using a proven set of proprietary processes, best practices and a portfolio-wide engagement model called RTP Change Management™. With offices in Boulder, CO, Palo Alto, CA and Stamford, CT, Rubicon has over $850 million in cumulative capital commitments. For more information, please visit www.rubicontp.com

World cup for rural connectivity

Saturday’s Rugby World Cup experience shows that New Zealand deserves a Broadband World Cup for getting broadband to its rural communities.

That’s the view of WISPA.NZ, the industry group supporting 28 Wireless Internet Service Providers who collectively provide broadband to an estimated 70,000 mostly rural customers.

“The great news is that WISPs dealt with the surge in traffic almost faultlessly,” WISPA Chairman Mike Smith said. “The problems were with the international link, and with some customer devices. But the part in between worked to perfection.

“WISPs can claim a lot of credit for bringing rural Kiwis in from the broadband boondocks. Tens of thousands of rural homes and businesses now have broadband at city speeds and city prices, with the number increasing daily.

“That’s something we wouldn’t have dreamed of a decade ago. Rural communities in New Zealand have far better broadband than most other Rugby World Cup countries, notably Australia.

“WISPs are committed to finishing the job, with government support, so every rural home and business can enjoy the benefits for social inclusion, entertainment and business. Connectivity to 100% of the community is within our sights.”

ENDS

—————————————————————————————————————————————

BACKGROUND NOTES

· – Most WISPs, or regional telecommunications companies, are locally owned businesses founded in the early 2000s.

· – Initially they used their own capital, but in recent times 17 of them have received government funding through the Rural Broadband Initiative to expand their networks into remote areas that would otherwise be uneconomic.

· – About half WISP connections use “WISP Wireless” – a series of hilltop towers with radios that bounce the Internet signal from one to another, then down to the homes below. The other half are re-sold services from other telcos.

· – WISP wireless requires line of sight visibility. Hence it requires many more towers than cellular services, but these are much lower cost.